You’re here because you typed something like “money market account calculator” into a search bar. You’re looking for a tool to tell you how much your savings can grow. And while there are plenty of simple tools out there, they often feel like a black box: you plug in some numbers, and an answer magically appears. But what does it all mean? How can you trust the result if you don’t understand the engine running under the hood?

Welcome to the ultimate user manual.

Instead of just giving you another tool, we’re going to give you something far more powerful: the knowledge to understand any money market calculator you find. We’ll deconstruct it piece by piece, so you can move from being a passive user to an informed investor. Because the truth is, the numbers you understand and choose to put in are far more important than the calculator itself.

Deconstructing the Calculator: Understanding the 5 Key Inputs

The Process of Calculating Your MMA Growth

Every single money market savings calculator, from the simplest to the most complex, relies on a few core inputs. Think of these as the ingredients in your recipe for financial growth. Getting them right is everything.

Principal: Your Starting Investment

This is your starting line. The principal is the initial lump sum of money you deposit into your money market account (MMA). It’s the seed from which all future growth will sprout. Whether it’s $500 from a tax refund or $25,000 you’ve carefully saved for a down payment, this number is the foundation of every calculation. A bigger principal means your interest has more to work with from day one.

APY vs. Interest Rate: The True Engine of Your Growth

This is arguably the most crucial—and most commonly misunderstood—input. You’ll see both “Interest Rate” and “APY” thrown around, but they are not the same.

- Interest Rate: This is the base rate of return your money earns, before any compounding effects are factored in. It’s an important number, but it doesn’t tell the whole story.

- APY (Annual Percentage Yield): This is the king of comparison. The APY represents your true rate of return over a year because it includes the effect of compound interest.

Expert Tip: When you’re comparing accounts or using a money market rate calculator, always, always use the APY. Two banks could offer the same 4.50% interest rate, but if one compounds interest daily and the other monthly, their APYs will be different. The APY is the only metric that gives you a true apples-to-apples comparison.

Compounding Frequency: The Hidden Accelerator

If APY is the engine, compounding frequency is the turbocharger. It refers to how often the interest you’ve earned is added back to your principal, where it then starts earning its own interest. The more frequently this happens, the faster your money grows.

Here are the common frequencies you’ll see on a money market calculator compounded daily or monthly:

- Annually: Once per year.

- Quarterly: Four times per year.

- Monthly: 12 times per year. (Very common)

- Daily: 365 times per year. (Often the best for savers)

While the difference might seem small day-to-day, over years, the power of more frequent compounding can add a surprising amount to your nest egg.

Additional Contributions: Systematically Fueling Your Balance

This is the input where you have the most control. Additional contributions are the regular deposits you plan to make into your account—for instance, $200 from every paycheck. While a calculator can project growth on your principal alone, factoring in consistent contributions dramatically changes the outcome. It’s the financial equivalent of adding more logs to the fire, ensuring your savings momentum never stalls.

Time Horizon: The Power of Patience

The final key input is time. This is how long you plan to let your money sit and grow. Compound interest is a marvel, but it needs time to work its magic. A projection over two years will look very different from one over ten years. The longer your time horizon, the more dramatic the upward curve of your balance will be as your interest starts earning more and more interest on itself.

The Core Engine: How to Calculate Money market Interest Manually

Ready to look inside the black box? Understanding how to calculate money market interest yourself is the key to true confidence. All those online tools are just running a simple, elegant formula in the background.

A Quick Refresher: The Simple Interest Formula

Before we tackle compounding, let’s start with the basics. Simple interest is calculated only on the original principal.

Formula: Simple Interest = Principal × Rate × Time

So, if you deposit $1,000 at a 5% simple interest rate for 3 years, you’d earn $150.

The calculation for this is: $1,000 × 0.05 × 3.

Your total is $1,150. It’s straightforward, but it’s not how modern savings accounts work.

The Main Event: The Compound Interest Formula Explained

This is the formula that powers every money market account interest calculator. It looks intimidating, but it’s simpler than you think.

Formula: A = P(1 + r/n)^(nt)

Let’s break down what each letter means:

- A = The future value of the investment/loan, including interest. This is the final number the calculator gives you.

- P = The principal amount (the initial amount of money).

- r = The annual interest rate (in decimal form, so 5% becomes 0.05).

- n = The number of times that interest is compounded per year.

- t = The number of years the money is invested for.

This formula calculates the final amount by repeatedly adding interest on top of a growing balance, based on the compounding frequency (n).

A Step-by-Step Calculation Example: Putting the Formula to Work

The Anatomy of a Money Market Calculation

Let’s imagine Maria, a freelance graphic designer who just landed a big project. She has $10,000 in extra cash she wants to put into an MMA for a future home office renovation.

Here are her variables:

- P = $10,000

- r = 4.5% (or 0.045)

- n = 12 (compounded monthly)

- t = 2 years

Step 1: Divide the rate by the compounding frequency.

r/n = 0.045 / 12 = 0.00375

Step 2: Add 1 to that number.

1 + 0.00375 = 1.00375

Step 3: Multiply the compounding frequency by the years.

n × t = 12 × 2 = 24 (This is the total number of compounding periods)

Step 4: Raise the result from Step 2 to the power of the result from Step 3.

(1.00375)^24 ≈ 1.0939

Step 5: Multiply the principal by the result from Step 4.

A = $10,000 × 1.0939 = $10,939

After two years, Maria’s initial $10,000 would grow to approximately $10,939. The interest on her money market account is $939.

Pro-Tip: Setting Up the Formula in Excel or Google Sheets

Don’t want to do the math by hand? You can easily become your own money market interest calculator in Excel or Google Sheets using the Future Value (FV) function.

Syntax: =FV(rate, nper, pmt, [pv], [type])

For Maria’s example (assuming no additional payments):

=FV(0.045/12, 2*12, 0, -10000)

This formula will give you the same result, $10,939. The initial deposit is negative because it represents a cash outflow (you’re putting it into the account).

What a Simple Calculator Won’t Show You: Advanced Factors

A standard calculator for a money market account gives you a clean, estimated number. But in the real world, a few other factors can influence your actual take-home earnings.

The Impact of Tiered Interest Rates on Your Real Return

Many banks, especially for an elite money market account, offer tiered rates. This means they pay a different APY based on your balance. For example:

- $0 – $9,999: 4.25% APY

- $10,000 – $49,999: 4.50% APY

- $50,000+: 4.75% APY

A simple calculator might not account for this. If your contributions push your balance into a higher tier midway through the year, your actual earnings will be slightly different from a calculation that uses a single rate for the entire period.

How Account Fees Can Silently Reduce Your Calculated Earnings

This is the silent killer of returns. A $5 or $10 monthly maintenance fee might not sound like much, but it’s a direct deduction from your earnings. Think of it as negative compounding. If your account earns $15 in interest one month but you’re charged a $10 fee, your net gain is only $5. Always look for accounts with no fees, or at least fees that are easily waived.

Factoring in Taxes: What You See Isn’t Always What You Keep

Unlike contributions to a Roth IRA, the interest earned in a standard money market account is considered taxable income. Each year, your bank will send you a 1099-INT form. You’ll need to report this interest on your tax return and pay taxes on it at your ordinary income tax rate. A calculator shows your gross earnings, not your after-tax net.

MMA vs. CD vs. HYSA Calculators: Understanding the Key Differences

You’re smart to consider MMAs, but you’ve likely seen tools like a CD calculator or a high-yield savings calculator, too. The reason they have separate tools comes down to one key difference in their calculations.

| Feature | Money Market Account (MMA) | Certificate of Deposit (CD) | High-Yield Savings (HYSA) |

| Rate Type | Variable. The rate can change at any time based on market conditions. | Fixed. The rate is locked in for the entire term of the CD. | Variable. Similar to an MMA, the rate can change at any time. |

| Calculation Certainty | A projection. A calculator provides an estimate based on the current rate. | A guarantee. A CD calculator can tell you exactly what you will earn. | A projection. Like an MMA, it’s an estimate based on the current rate. |

| Flexibility | High. You have check-writing privileges and easy access to your money. | Low. You are penalized for withdrawing money before the term ends. | High. You have easy access to your money (up to 6 withdrawals per month typically). |

Understanding this table is key. When you use a money market savings account calculator, you’re getting a snapshot in time. Because the APY is variable, your actual return could be higher or lower if the bank changes its rates. With a CD, the calculation is a firm promise.

Your Financial Toolkit, Upgraded

You came looking for a simple tool, but now you have something much better: a complete understanding of the mechanics behind your money’s growth. You know that the APY is the most honest metric, that compounding frequency is a hidden booster, and that the compound interest formula isn’t magic—it’s just math.

You can now approach any money market account calculator—whether it’s a generic one online or a branded tool from Ally, Fidelity, or Navy Federal—with confidence. You know what the inputs mean, how the engine works, and what advanced factors to consider.

Now that you’ve mastered the mechanics, are you ready to learn the strategies? Your next step is to discover how to find the very best inputs for that formula—the highest APYs, the lowest fees, and the smartest contribution strategies.

Ready to apply this knowledge? Read our guide on How to Maximize Your Interest to turn your understanding into a powerful savings plan.

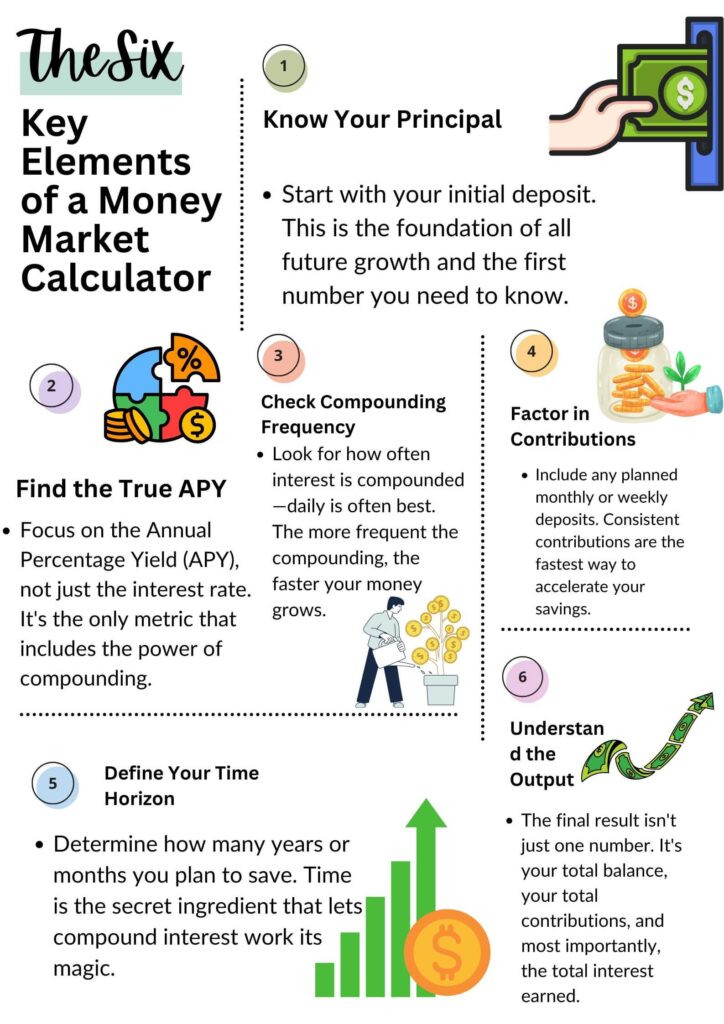

The 6 Key Elements of a Money Market Calculator