Ugh, bankruptcy. If just seeing that word makes your stomach do a little flip, believe me, you’re not alone. It’s a tough road. And if you’re now looking at your current ride (or lack thereof) and thinking, “How on earth am I going to get a car loan after this?”, well, you’ve landed in the right spot. It might feel like all the doors have slammed shut, especially when you’re trying to find banks that work with bankruptcies for auto loans.

But here’s a little secret from us here at MoneMoney.com: getting back on the road, with a reliable car, is often way more possible than you think. A car isn’t just a nice-to-have; it’s your lifeline to work, to school, to… well, life! So, take a deep breath. We’re going to walk through this together, find those lenders who actually get it, and help you figure out your next move for bankruptcy auto financing.

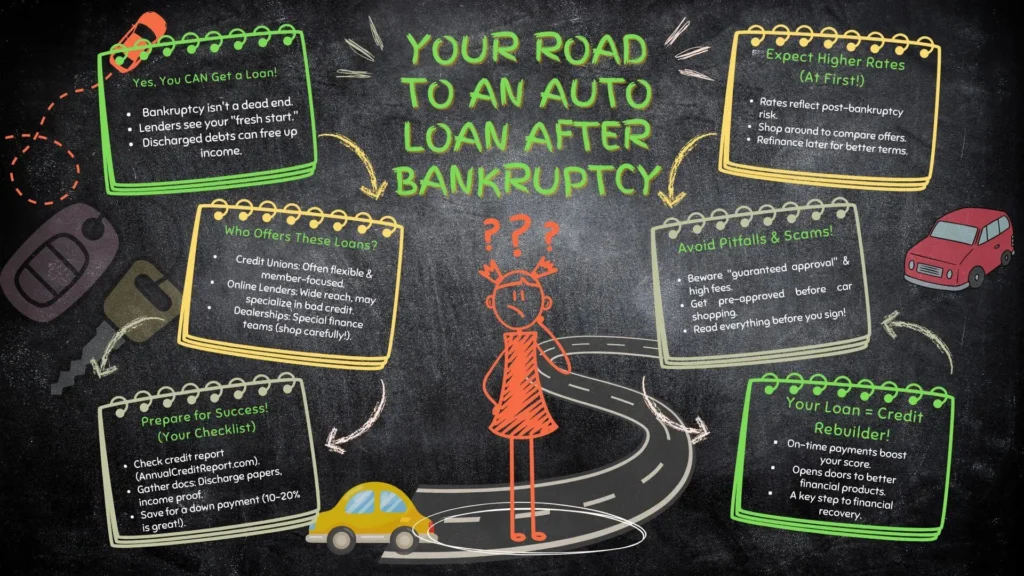

The Good News: Seriously, You Can Get a Car Loan After Bankruptcy!

First things first, let’s bust a big myth. A bankruptcy on your record doesn’t mean you’re wearing a giant “No Loans For You!” sign for the rest of your life. Not even close. Lots of folks successfully can you get a car loan after bankruptcy, and sometimes, it happens quicker than they ever imagined.

So, Why Would Anyone Lend You Money? Good Question!

I know what you’re probably thinking: “Hang on. I just had a bunch of debt wiped out or reorganized. Why would any lender trust me with more money?” Totally fair question! But here’s the thing – post bankruptcy auto lenders look at your situation a bit differently now:

- You’re Actually Less of a Risk (In Some Ways): Sounds weird, right? But after a Chapter 7 bankruptcy, for example, a lot of your old unsecured debts (think credit cards, medical bills) are gone. Poof! This means your debt-to-income ratio – how much you owe versus how much you make – can look a whole lot healthier. You’ve actually got more breathing room in your budget.

- They Know You Need a Car: Lenders aren’t living under a rock. They get that you need a car to get to that job that helps you pay your bills (including a new car payment!).

- The “Can’t File Again Soon” Factor: After a Chapter 7 discharge, there’s a waiting period before you can file again. This, believe it or not, can make you slightly less risky for a new, secured loan like a car loan. The lender knows this new debt isn’t likely to just disappear in another bankruptcy tomorrow.

- From the lender’s point of view, the car itself makes the loan a bit safer for them. Essentially, with an auto loan, the car itself stands as collateral. If things go sideways and you can’t pay (which no one wants!), the lender can take the car back to help cover their loss. It’s a safety net for them.

Your “Fresh Start” Includes Getting Around

The whole idea behind bankruptcy in the U.S. is to give people a genuine fresh start. Think about it – it’s tough to truly embrace that ‘fresh start’ you’re working towards if you’re stuck without a way to get to a crucial job interview, right? Lenders who offer bankruptcy friendly car loans understand this. They’re looking at your current ability to pay and your drive to move forward, not just dwelling on the past.

Imagine someone like Sarah, a teacher in Florida who just got through her Chapter 7. Her old car, bless its heart, was on its very last wheel, needing more than a little luck just to make it down the street. She was stressed, thinking she’d be stuck. But she found a credit union that looked at her steady income and her clear need, offering her a chance to get reliable wheels. That’s what we’re talking about.

Timing is Key: When Can You Actually Get That Car Loan?

So, what’s likely at the very top of your mind right now? I’d bet it’s something like, ‘how long after bankruptcy can I get a car loan?’ There’s no single, fits-everyone answer, unfortunately. It really depends on what type of bankruptcy you filed and how your finances look right now.

Auto Loans After Chapter 7 Discharge: What’s the Deal?

Once you get that official Chapter 7 discharge paper – congrats, that’s a huge milestone! – you’re technically good to go for new credit. You might be surprised that you can often get an auto loan after chapter 7 discharge pretty quickly. We’re talking potentially within days or weeks, especially if you’ve got a steady job and a bit of cash for a down payment.

- Insider Tip: Some lenders like to see a little dust settle, maybe a month or two after your discharge. This gives your credit report time to update properly and for you to maybe stash away a bit more for that down payment. It’s not a hard rule, but it can sometimes smooth things out.

Getting a Car Loan During an Active Chapter 13: A Bit More Footwork

If you’re currently in a Chapter 13 repayment plan, getting a new car loan is a bit more of a dance, but definitely still on the table. Since you’re working with the court and a trustee, there are a few extra hoops:

- Gotta Get the Trustee’s Okay: You can’t just go out and sign loan papers. You’ll need to ask the bankruptcy court and get permission from your Chapter 13 trustee. They’ll want to make sure the new loan is truly necessary (like your old car gave up the ghost) and that the payment won’t mess up your existing repayment plan.

- Finding the Right Lender: You’ll need to seek out auto lenders that work with chapter 13. These folks know the drill with trustee approvals and aren’t scared off by it.

Think of Mark, a plumber in California in the middle of his Chapter 13. His work truck died, and without it, his income (and his ability to keep up with his plan) was toast. His lawyer helped him get the court’s permission, and he found a local lender who specialized in these exact situations. It took a bit more paperwork, but he got his new truck.

What Makes Lenders Say “Yes” Sooner?

- Steady Paychecks: Showing you have regular income coming in is huge.

- Cash on Hand: A decent down payment? That’s music to a lender’s ears.

- A Clean(er) Credit Report: Make sure those old debts are showing as “discharged.”

- The Right Lender: Honestly, some are just more open to post-bankruptcy borrowers than others.

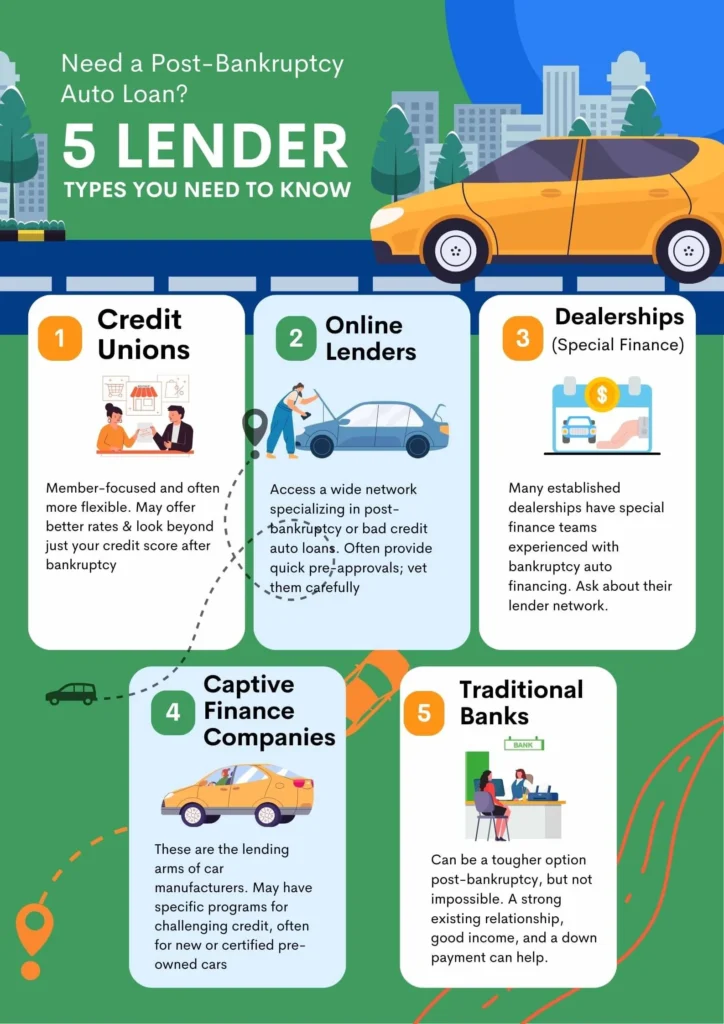

Who Actually Offers These Loans? Top 5 Places to Look for Banks and Lenders That Work with Bankruptcies

Okay, so your old bank might give you the side-eye, but don’t sweat it. The world of banks that work with bankruptcies for auto loans is bigger than you think. Here are your top five go-to spots to find the best auto loan after chapter 7 or while you’re navigating Chapter 13:

1. Credit Unions: Your Friendly Neighborhood Lender

Seriously, credit unions are often the unsung heroes for bankruptcy friendly car loans. They’re not like big, impersonal banks. They’re non-profits owned by their members (that could be you!).

- Why Credit Unions Rock for This:

- They See You, Not Just a Number: They’re often more willing to listen to your story and look at your whole situation, not just a credit score that’s taken a beating.

- Better Rates, Usually: Because they’re not trying to make a massive profit for shareholders, their interest rates and fees can be kinder.

- They Genuinely Want to Help: It’s often part of their mission to help folks in their community get back on their feet.

- Finding a Bankruptcy-Friendly Credit Union:

- Start local! Check out credit unions in your town or county.

- Pop onto their website or, even better, give them a call. Tell them your situation – they’ve heard it before.

- You usually just need to live, work, worship, or go to school in their area to join.

2. Online Lenders & Those Techy Fintech Companies: Fast and Wide-Reaching

The internet has opened up a ton of options with online lenders. Many of them specialize in helping people with bumpy credit histories, including those who’ve been through bankruptcy.

- The Good and The Not-So-Good of Online Lenders:

- The Good: You can apply from your couch, often get pre-approved super fast, and easily compare offers. No need to drive all over town.

- The Not-So-Good: It can feel a bit impersonal. You really have to read the fine print on terms and fees. And make super sure they’re legit.

- How to Sniff Out a Good Online Lender:

- Are their terms clear as day? Or hidden in tiny print?

- What are people saying in bk auto loans reviews? (Take these with a grain of salt, but look for common themes.)

- Can you actually find a phone number or real customer support?

- Check them out on the Better Business Bureau.

3. Captive Finance Companies: The Car Maker’s Own Bank

These are the finance companies that belong to the big car brands – think Ford Credit, Honda Financial Services, etc. Their main job is to help sell their cars.

- How They Can Help Post-Bankruptcy:

- Sometimes they have special programs for folks with credit challenges, especially if you’re looking at a new or certified pre-owned car from their brand.

- They want to move cars off the lot, so they can sometimes be surprisingly flexible.

- You usually access these through the dealership’s finance office when you’re shopping.

4. Good Car Dealerships with “Special Finance” Teams

Yep, there are car dealerships that work with bankruptcies and have finance folks who know this stuff inside and out. They’re used to the paperwork and the process for bankruptcy auto financing.

- Finding a Dealership You Can Trust (This is Key!):

- Be Wary of “Buy Here, Pay Here” (BHPH) Places: We know, sometimes they seem like the only option. But oh boy, those interest rates can be brutal, and the cars might not be in the best shape. If you can avoid them, please try.

- Stick with Established Dealers: Those big-name new car dealerships (your local Ford, Toyota, Chevy dealer) usually have more reputable special finance options.

- Read Online Reviews (Specifically About Financing): See what other people say about their experience getting a loan there after a bankruptcy or with bad credit.

- Smart Questions to Ask Their Finance Manager:

- “Have you helped people get car loans right after bankruptcy before?”

- “Which lenders do you usually partner with for situations like mine?”

- “Can you walk me through all the fees and the interest rate before I sign anything?”

- “Is this loan coming directly from a bank/credit union, or is it your own in-house financing?” (In-house can sometimes mean higher rates).

5. Your Regular Bank? Maybe! (But Don’t Pin All Your Hopes Here)

Okay, so many big traditional auto finance banks can be a bit skittish about recent bankruptcies. But it’s not a total lost cause, especially if you had a good relationship with them before everything went south, or if you can show them a really strong financial picture now.

- When Your Old Bank Might Say Yes:

- If you kept your checking/savings with them and it’s in good standing.

- If your bankruptcy didn’t involve any loans you had with them.

- If you’ve got a hefty down payment and proof of really solid income now.

- How to Talk to Your Bank About a Car Loan After Bankruptcy:

- Just be straight up. Tell them what happened and what your situation is now.

- Have all your paperwork ready to go (discharge papers, pay stubs, the works).

- Focus on the positive – your new job, your budget, how you’re moving forward.

- Sometimes, a smaller community bank is more flexible than a giant national one.

- Comparing Lender Types for Post-Bankruptcy Auto Loans

| Lender Type | Key Features / Pros | Points to Watch / Cons | Best Suited For… |

| 1. Credit Unions | – Member-focused, often more personal – Potential for flexible terms & lower rates – May look beyond just credit score | – Membership required – Process might be slightly slower | – Those seeking a community feel & potentially better terms – Individuals valuing a personal banking relationship |

| 2. Online Lenders | – Wide network of lenders – Often quick pre-approvals – May specialize in bad credit/bankruptcy | – Can be less personal – Crucial to vet reputation thoroughly – Rate variability can be high | – Borrowers needing fast options – Those who want to easily compare multiple offers online |

| 3. Dealerships (Special Finance) | – Experienced with bankruptcy situations – Convenience of one-stop shopping (car & loan) | – Risk of higher interest rates – Be cautious with “Buy Here, Pay Here” (BHPH) lots | – Individuals preferring a streamlined car-buying and financing process (with due diligence) |

| 4. Captive Finance Companies | – Lender arms of car manufacturers – May have programs for challenging credit – Good for new or CPO vehicles | – Tied to specific car brands – Usually accessed through the dealership | – Buyers set on a particular car brand – Those looking for manufacturer-specific financing deals |

| 5. Traditional Banks | – Existing banking relationship can help – Familiar, established structures | – Often stricter underwriting post-bankruptcy – May offer less flexibility | – Borrowers with a strong existing bank relationship – Those with a solid financial profile post-bankruptcy |

Getting Your Ducks in a Row: Your Game Plan for a Bankruptcy-Friendly Car Loan

Alright, let’s be real. Getting a car loan with bankruptcy isn’t quite as simple as ordering a pizza. It takes a bit more prep work than if your credit was sparkling. But putting in this effort now can make a huge difference in not only getting approved but also getting decent terms.

Know Where You Stand: Your Credit Report and Score Post-Bankruptcy

First things first: after your bankruptcy is discharged, grab your credit reports. You can get them for free once a year from each of the big three (Equifax, Experian, TransUnion) at AnnualCreditReport.com.

- Play Detective: Read through them carefully. Are all those old debts you discharged actually showing a zero balance and marked “discharged in bankruptcy”? If not, dispute those errors ASAP!

- Take a Peek at Your Score: Yeah, it’s probably taken a hit. Try not to freak out about the number itself right now. Especially after a bankruptcy, lenders look at more than just that three-digit score.

- “Good Enough” Score? It’s Complicated: There isn’t some magic minimum credit score to get an auto loan from a bank (or anyone else) after bankruptcy. Some lenders who specialize in this stuff might work with scores down in the low 500s. Others might want to see something a bit closer to 600. It’s really about the whole package: your income, your down payment, how stable things are. And Is 650 a good credit score? Generally, yeah, 650 is considered fair to good. It would definitely open more doors post-bankruptcy than a score in the 500s.

Your Paperwork Power Pack: What Lenders Want to See

Get these documents together in a folder so you’re ready to roll:

- Your Bankruptcy Discharge Papers: This is the golden ticket.

- Proof You’re Earning: Recent pay stubs (last month or two), W2s, or tax returns if you’re self-employed.

- Proof You Live Somewhere: A recent utility bill or your lease agreement.

- Your Driver’s License and Car Insurance Info.

- If You’re in Chapter 13: That court order or letter from your trustee saying it’s okay to get a loan.

- Bank Statements: To show your income going in and that you’re managing your money okay.

Cash is King (or at Least Really Helpful): The Down Payment

A down payment? Yeah, you’re almost certainly going to need one for bankruptcy auto financing.

- How Much is “Enough”? If you can swing 10-20% of the car’s price, that’s awesome. The more you put down, the less you borrow, which means less risk for the lender (and maybe a better interest rate for you!). Even $500 or $1,000 can make a difference if that’s all you can manage. Every bit helps.

- Where’d You Get It? Be ready to show where that cash came from (savings, a tax refund, etc.).

Steady Eddie Income: Showing You Can Make Those Payments

This might be the biggest thing lenders look at. Can you consistently afford the monthly payment on top of your rent, groceries, and everything else? A steady job, even if it’s one you got after the bankruptcy, speaks volumes.

You’ve Got This: Applying for the Loan & Dodging Problems with Post-Bankruptcy Auto Lenders

Okay, you’ve scouted some lenders, you’ve got your paperwork. What now?

Keeping it Real: What to Expect with Interest Rates and Loan Terms

Let’s be upfront: your interest rate probably isn’t going to be what your friend with an 800 credit score got. That’s just the reality when credit has taken a hit. Who has the lowest car loan rates? People with perfect credit, usually. Your goal right now is to get a fair loan you can actually afford, one that will help you rebuild.

- Interest Rates: They can be all over the map, sometimes in the high teens or even sniffing 20% APR or more. It really depends on your situation and the lender. This is why you have to shop around!

- Loan Length: You might get offered a super long loan (like 6 or 7 years!) to make the monthly payment look tiny. Be careful! The longer the loan, the more interest you pay – a lot more.

- Down Payment Minimums: There’s no set-in-stone minimum percentage for car loan down payments, but like we said, aim for 10-20% if you can. Lenders will have their own rules.

Get Pre-Approved First! Shop Like You’ve Got Cash in Your Pocket

If you can, try to get pre-approved for a loan before you even step onto a car lot.

- Why This is a Smart Move:

- You’ll know exactly how much car you can actually afford. No falling in love with something out of reach.

- It gives you serious bargaining power at the dealership. You’re not desperate for their financing.

- You can compare offers from different lenders (your credit union vs. that online place) and pick the best one.

Warning Signs! How to Spot Lenders and Deals That Are Bad News

Sadly, there are folks out there who try to take advantage of people who are in a tight spot. Keep your radar up for these red flags:

- “Guaranteed Approval! No Problem!” Uh, no. Legitimate lenders need to check your info. If it sounds too good to be true, it probably is.

- Fees, Fees, and More Fees: Ask about all the fees – origination, documentation, processing – and make sure they’re not outrageous.

- High-Pressure Sales for Add-Ons: Extended warranties, GAP insurance, credit life insurance… they’ll try to sell you the moon. Some might be useful, but they’re often way overpriced. It’s okay to say “no thanks.”

- The “Yo-Yo” Scam: You sign papers, drive the car home, and then days later the dealer calls saying the financing “fell through” and you need to come back and sign for a much worse deal (or give the car back). This is awful. Try to have your own financing locked in first, or make absolutely sure everything is 100% final before you leave with the keys.

- Blank Lines on the Contract: Never, ever sign anything that has blank spaces. Period.

This Car Loan? It’s Your Credit Rebuilding Tool!

Think of this first car loan after bankruptcy as more than just a way to get from A to B. It’s a chance to show the credit world you’re back on track.

On-Time Payments = Credit Score Gold

Making those car payments on time, every single month, is one of the best things you can do to heal your credit score. Each good payment is like a gold star on your report.

Refinance Later for a Better Deal!

Here’s a pro tip: after about a year or 18 months of faithfully making those payments on time (and keeping the rest of your credit clean), your score should be looking much better. Then, you might be able to refinance that bankruptcy auto loan for a lower interest rate and save yourself a chunk of change. It’s a super common strategy for folks who had to take a higher rate right after bankruptcy.

Still Got Questions? FAQs on Banks and Auto Loans After Bankruptcy

Chances are, a few more questions are rattling around in your head. Let’s get to ’em!

What’s the absolute lowest credit score to get a car loan from a bank after bankruptcy?

Like we said, there’s no single magic number. Lenders who specialize in this area look at your whole story – your job, how much you make, your down payment, how long ago the bankruptcy was. Some might work with scores in the 500s, others might want to see something north of 600. Instead of obsessing over the score, focus on making the rest of your application as strong as possible.

Those “bk auto loans reviews” online – can I trust them?

Ehhh, be a little skeptical. Online reviews can give you a peek, but they can also be fake or just one person’s really good or really bad day. Look for patterns. Are lots of people saying the same thing (good or bad) across different review sites like the BBB, Google, or even finance forums? Pay more attention to reviews that talk about the actual process and the terms they got, not just “5 stars, great!”

Any chance I can snag a 0% interest car loan after bankruptcy?

Let’s be real: getting a 0% interest rate on car loan right after bankruptcy is probably a unicorn. Those deals are usually for people with stellar credit buying brand new cars from certain makers. Right now, your main goal is to get a loan you can manage that helps you rebuild. The super-low rates can come later.

So, who really has the lowest car loan rates for people with a bankruptcy?

Credit unions often come out on top here, with generally better rates for post-bankruptcy borrowers than you might find at specialized subprime lenders or through some dealership financing. But – and this is a big but – you have to shop around. Get quotes from a few different types of lenders, because what one offers can be totally different from another.

You’re Driving This Thing: Final Thoughts on Your Post-Bankruptcy Car Loan Journey

Whew! That was a lot, wasn’t it? But finding banks that work with bankruptcies for auto loans – or really, any lender who’s willing to see you as a person, not just a credit file – is totally within reach. It just takes a bit of know-how, some patience, and a refusal to give up.

Here are the big things to remember:

- It IS Possible: Don’t let that bankruptcy cloud make you think you’re stuck.

- Do Your Homework: Know your credit situation, get your papers in order, and research lenders like a pro.

- Shop Around (Seriously!): Don’t take the first offer you get. Compare rates and terms from credit unions, online folks, and maybe even a dealership or two.

- Save That Down Payment: It’s like a secret weapon.

- Read Every. Single. Word: Before you sign on that dotted line, make sure you understand it all.

- This is Your Comeback Story: Those on-time payments are your ticket to a brighter financial future.

Getting a car loan with bankruptcy might feel like climbing a mountain right now, but armed with the right info and a can-do attitude, you can absolutely get yourself a reliable car and a fresh start on the road. You’ve absolutely got this!