Ever feel like your money has a mind of its own, slipping through your fingers no matter how hard you try to hold on?

You’re not alone. For many of us, especially when we’re starting out or navigating new life stages like buying a home or planning for a family, managing finances can feel like trying to solve a complex puzzle without all the pieces.

You see the ads, the success stories, the folks who seem to have it all figured out, and you wonder, “What’s their secret?” Often, it’s not some complex Wall Street wizardry; it’s something far more accessible: a solid plan, often guided by one of the many excellent budget books available today. The term “budget books” itself can be a bit of a chameleon.

Does it mean a thick textbook filled with economic theories, or a practical notebook you scribble in? The truth is, it’s both, and understanding that distinction is the first step toward finding the right tool to transform your financial life. This isn’t just about counting pennies; it’s about gaining control, reducing stress, and ultimately, using your money to build the life you truly want.

This guide is your roadmap to understanding and choosing the best budget books – whether you’re looking for profound financial wisdom or a straightforward budget planner – to finally make your money work for you.

What Exactly Are “Budget Books” and Why Do You Need One?

Let’s clear up any confusion right from the start. When we talk about budget books, we’re stepping into a world of tools designed to bring clarity and control to your financial picture. But not all budget books are created equal, nor do they serve the same exact purpose.

Decoding “Budget Books”: More Than Just Numbers

“A budget is telling your money where to go instead of wondering where it went.” Dave Ramsey

Think of “budgeting” not as a restrictive chore, but as a powerful act of intention. It’s about telling your money where to go, instead of wondering where it went. Budget books, in their various forms, are the compass and the map for this journey.

They help you move from a reactive state – “Oh no, where did my paycheck go?” – to a proactive one – “I know exactly how my money is supporting my goals this month.”

The core issue many face is a disconnect between their income and their aspirations. We earn, we spend, but often without a clear understanding of the flow or a strategy to align that flow with what truly matters.

It can feel like you’re running on a financial treadmill, working hard but not really getting anywhere.

This is where the right budget book steps in, not just as a ledger, but as a catalyst for change. The stakes are high: less financial stress means more peace of mind, better relationships (money is a common source of conflict, after all!), and the ability to pursue bigger dreams, whether that’s a down payment on a house in Austin, Texas, or finally starting that side hustle you’ve been dreaming about.

The Two Main Types: Educational Guides vs. Practical Planners

To navigate the world of budget books effectively, it’s crucial to understand the two primary categories:

- Educational Budget Books (Guides & “Books on Budget”): These are the books on budget you read to learn. Penned by financial experts, seasoned savers, or even everyday folks who’ve cracked the code, these guides delve into the why and how of money management. They explore:

- Fundamental principles of budgeting and personal finance.

- Different budgeting strategies and philosophies.

- Tips for saving money, getting out of debt, and investing.

- Mindset shifts necessary for long-term financial success.

- These are the books that build your financial literacy.

- Practical Budget Planners (Budget Books as Tools): These are the budget books (often called budget planners or budget and finance planners) you use to do the work. They are tangible tools, usually in notebook format, designed for:

- Tracking your income and expenses.

- Categorizing your spending.

- Setting and monitoring financial goals.

- Managing bills and debt repayment.

- Many include features like an expense tracker, bill organizer, or even a monthly planner with budget pages. Some even come with a handy budget book with money pouch for cash envelope systems.

Understanding this distinction is key. Are you looking to build your knowledge base first, or are you ready to dive into a practical tracking system? Many people find they need both!

The Real-World Benefits: How Budget Books Transform Your Finances

“Financial peace isn’t the acquisition of stuff. It’s learning to live on less than you make, so you can give money back and have money to invest. You can’t win until you do this.” – Dave Ramsey

Why bother with budget books when you could just “wing it”? Because “winging it” rarely leads to financial peace. The benefits are tangible and life-changing:

- Clarity and Awareness: You’ll finally know exactly where your money is going. No more end-of-month surprises.

- Control Over Spending: A budget book empowers you to make conscious spending decisions aligned with your priorities, rather than being driven by impulse.

- Achieving Financial Goals: Whether it’s saving money for a vacation, paying off student loans, or building an emergency fund, a plan makes it possible. For instance, Sarah, a graphic designer in Portland, used a simple budget planner to track her freelance income and expenses, allowing her to save enough for a down payment on a new laptop for her business in just six months.

- Reduced Financial Stress: Knowing you have a plan and are in control significantly reduces anxiety about money.

- Improved Financial Habits: Consistently using a budget book helps instill discipline and positive money management skills that last a lifetime.

- Better Communication (for couples): If you share finances, a budget book can be a neutral tool to facilitate open conversations about money and shared goals.

Building Your Financial Foundation: Key Budgeting Concepts to Know Before You Dive In

Before you rush out to grab the first budget book you see, understanding a few core budgeting principles can make your journey much smoother and more effective.

Think of this as learning the rules of the road before you start driving. Many books on budget for beginners cover these, but here’s a quick primer.

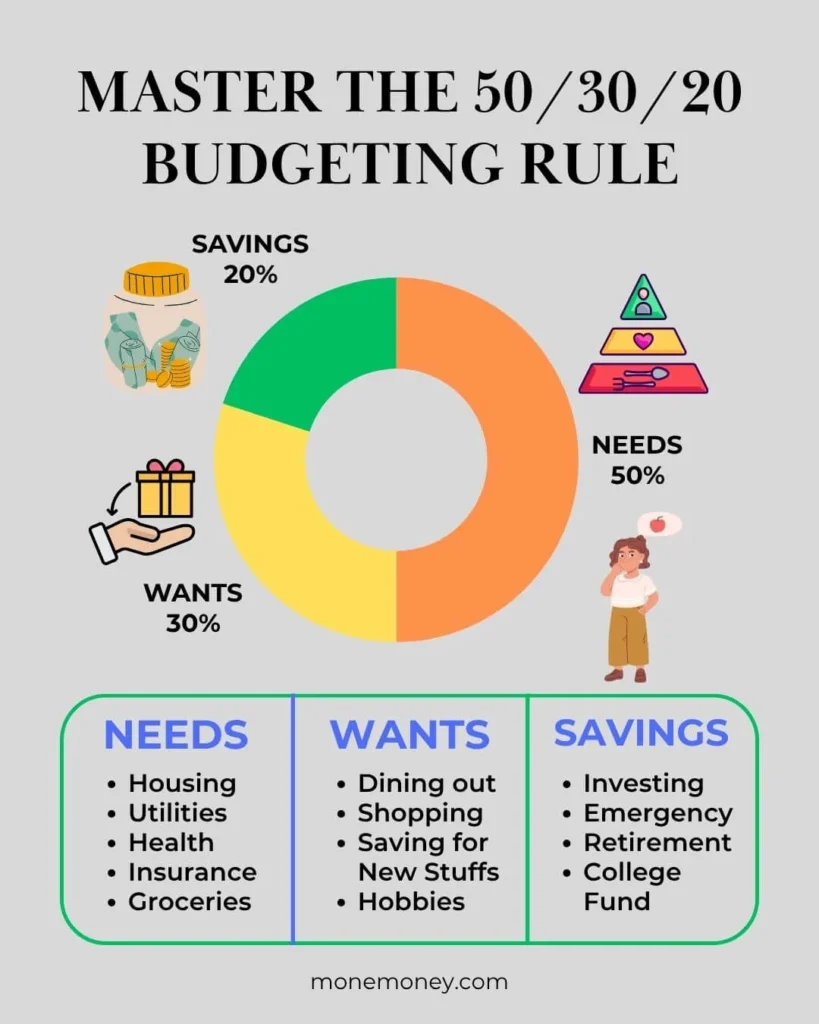

What is the 50/30/20 Budget Rule and How Can it Help?

You’ve likely heard of the 50/30/20 rule – it’s a popular and straightforward way to allocate your after-tax income, especially if you’re new to budget planning. Here’s the breakdown:

- 50% for Needs: This portion covers your essential living expenses. Think housing (rent/mortgage), utilities, groceries, transportation to work, insurance, and minimum debt payments. These are the must-haves.

- 30% for Wants: This is for discretionary spending – things that enhance your lifestyle but aren’t strictly necessary. This includes dining out, hobbies, entertainment, travel, and new clothes (beyond the absolute essentials).

- 20% for Savings & Debt Repayment: This crucial slice goes towards building your financial goals. This includes contributions to your emergency fund, retirement accounts (like a 401(k) or IRA), investments, and extra payments towards high-interest debt (like credit cards or personal loans).

How it helps: The 50/30/20 rule provides an easy-to-understand framework that prevents you from overspending in one area at the expense of another, especially your savings. It’s a great starting point for many people, particularly budgeting books for young adults often highlight this method.

Exploring Other Popular Methods: The 70/10/10 Rule, Envelope Budgeting, and Zero-Base Budgeting

While 50/30/20 is popular, it’s not the only game in town. Different personalities and financial situations might benefit from other approaches often discussed in budget books:

- The 70/10/10 Rule (often seen as 70/10/10/10 for tithing/charity): A simpler allocation where, for example, 70% goes to spending, 10% to saving, 10% to investing, and 10% to giving/charity. It’s less granular but can work for those who prefer broader strokes.

- Envelope Budgeting: A very hands-on method, especially effective for curbing overspending in specific categories. You allocate cash into labeled envelopes for different expenses (e.g., “Groceries,” “Entertainment”). Once the cash in an envelope is gone, you stop spending in that category for the month. Many find a budget book with money pouch helpful for this.

- Zero-Base Budgeting: This method requires you to assign every single dollar of your income to a category (spending, saving, debt repayment) until your income minus your expenses equals zero. It’s meticulous and ensures no money is left unaccounted for. This is a powerful technique often detailed in more advanced books on budgeting.

Are you wondering which one is “best”? There’s no single right answer. The “best” method is the one that you understand, can realistically implement, and that helps you achieve your financial goals.

The 3 P’s of Budgeting: Planning, Patience, and Persistence

“Planning is bringing the future into the present so that you can do something about it now.” – Alan Lakein

Regardless of the specific budget book or method you choose, success hinges on three key principles – the “3 P’s of Budgeting”:

- Planning: This is where your budget book shines. It’s about proactively deciding how you’ll use your money before you spend it.

- Patience: You won’t become a budgeting guru overnight. There will be slip-ups. Be patient with yourself, learn from mistakes, and keep going. Building new habits takes time.

- Persistence: Sticking with your budget, even when it’s tough or boring, is crucial. Consistency is what builds momentum and delivers long-term results.

Think of these 3 P’s as your guiding stars. Without them, even the best books on budget or the most sophisticated budget planner will just gather dust.

Overview of Popular Budgeting Methods

| Budgeting Method | Core Principle | Pros / Advantages | Cons / Things to Keep in Mind | Ideal For |

| The 50/30/20 Rule | Divides after-tax income: 50% for Needs, 30% for Wants, 20% for Savings & Debt Repayment. | Easy to understand and implement, good framework for beginners, prevents overspending in one area. | May not be detailed enough for some, might not aggressively tackle debt without adjustments. | Budgeting beginners, those looking for a simple, straightforward framework. |

| The 70/10/10 Rule | Simpler allocation: e.g., 70% Spending, 10% Saving, 10% Investing, 10% Giving/Charity. | Simpler and less granular than 50/30/20, offers broader strokes for spending. | Can be too general, may not pinpoint overspending areas precisely. | Those who prefer a big-picture view, individuals who integrate giving as a core budget item. |

| Envelope Budgeting | Allocates cash into labeled envelopes for expense categories. Spending stops when an envelope is empty. | Very effective for curbing overspending in specific categories, makes spending tangible. | Impractical for online purchases or those who rarely use cash, requires discipline. | Those struggling with overspending in certain areas, cash users, tactile budgeters. |

| Zero-Base Budgeting (ZBB) | Income minus all expenses (spending, saving, debt repayment) must equal zero. Every dollar is assigned a job. | Ensures no money is unaccounted for, provides a very clear picture of cash flow, meticulous. | Time-consuming, can be overwhelming for beginners or those with irregular income. | Detail-oriented individuals, those with relatively stable income, maximizers of every dollar. |

Choosing Your Weapon: How to Select the Perfect Budget Book or Planner for You

Now that you understand the “what” and “why” of budget books and some core principles, how do you pick the right one from the sea of options? It’s less about finding a universally “perfect” budget book and more about finding what’s perfect for your current needs, personality, and goals.

Are you a detail-oriented person, or do you prefer a big-picture approach? Do you find satisfaction in writing things down, or are you more digitally inclined?

For the Knowledge Seekers: What to Look for in an Educational Budget Book

“An investment in knowledge pays the best interest.” – Benjamin Franklin

If your primary goal is to build your financial literacy and understand the principles behind effective money management, an educational budget book (one of those insightful books on budget) is your starting point. Look for:

- Author Credibility & Expertise: Is the author a recognized financial expert, a successful investor, or someone with a proven track record and relatable story?

- Clarity and Accessibility: The concepts should be explained in plain English, avoiding overly technical jargon. This is especially important for books on budget for beginners.

- Actionable Advice & Real-World Examples: Good theory is one thing, but the book should offer practical steps you can implement and examples that resonate with a U.S. audience (e.g., saving for retirement using a Roth IRA, managing student loan debt).

- Relevance to Your Stage of Life: If you’re a recent grad, a budgeting book for young adults might speak more directly to your challenges than one aimed at retirees.

- Positive and Empowering Tone: The book should leave you feeling motivated and capable, not overwhelmed or shamed.

For the Action Takers: Essential Features of a Great Budget Planner

If you’re ready to roll up your sleeves and start tracking, a practical budget planner (the physical budget book tool) is what you need. Consider these features:

- Layout and Organization: Is it intuitive? Does it have clear sections for income, different expense categories, debt tracking, and savings goals? Are there monthly planner with budget pages for an overview?

- Tracking Categories: Does it offer pre-set categories, or is there flexibility to create your own?

- Goal Setting Sections: A good budget and finance planner will have dedicated space to write down your short-term and long-term financial goals and track your progress.

- Durability (if physical): Will it hold up to daily or weekly use for a year?

- Expense Tracker / Bill Organizer Capabilities: How well does it help you log every expense and keep track of upcoming bills?

- Extra Features: Some people love a budget book with money pouch for cash systems, while others might look for sticker pages or motivational quotes.

- Size and Portability: Do you want something you can carry with you, or a larger desk version?

Don’t just grab the prettiest one! Think about how you’ll actually use it. A planner that looks great but doesn’t fit your tracking style will quickly be abandoned.

Physical vs. Digital: Weighing Your Options in the Modern Age

The classic image of a budget book is a physical notebook. However, we live in a digital world.

- Physical Planners:

- Pros: Tangible satisfaction of writing things down, no distractions from apps/notifications, doesn’t require batteries. Many find the physical act of writing helps reinforce habits.

- Cons: Can be bulky to carry, requires manual calculations, can be lost or damaged.

- Digital Solutions (Apps, Spreadsheets, budget book pdf templates):

- Pros: Often sync with bank accounts for automatic expense tracking, calculations are done for you, accessible on multiple devices, many free books on budget principles are available as PDF guides or app features.

- Cons: Can have a learning curve, may involve subscription fees, potential security concerns, easy to ignore notifications.

There’s no right or wrong here. Some people use a physical budget planner for daily tracking and a budgeting app for an overview. The key is finding a system you’ll consistently use.

MoneMoney.com’s Top Picks: The Best Budget Books and Planners for Current Year

Alright, you understand what budget books are, why they’re crucial, and some core budgeting principles. Now for the part many of you have been waiting for: which ones should you actually consider? We’ve sifted through countless options, focusing on those that offer genuine value, clarity, and practicality for our MoneMoney.com readers, especially those who are beginners or young adults looking to make smart money moves. Remember, the best budget book or budget planner is ultimately the one you’ll use consistently.

Best Overall Budget Book for Financial Literacy (Educational Guide)

- Title Suggestion: “I Will Teach You To Be Rich” by Ramit Sethi

- Why it’s a top pick: Don’t let the somewhat brash title fool you. This isn’t a get-rich-quick scheme. Ramit Sethi offers a practical, no-nonsense 6-week program focusing on automation, conscious spending, and building wealth for the long term. It’s one of the best books on budgeting and saving money because it shifts your mindset about money from restriction to intentionality.

- Key Takeaways: Actionable steps for automating savings and investments, scripts for negotiating bills, and a focus on spending extravagantly on the things you love while cutting costs mercilessly on things you don’t.

- Best for: Young professionals, those looking for a comprehensive system, and anyone tired of traditional, overly restrictive budgeting advice.

Top Choice for Budgeting Beginners (Educational Guide)

- Title Suggestion: “The Total Money Makeover” by Dave Ramsey

- Why it’s a top pick: For those truly starting from scratch or feeling overwhelmed by debt, Dave Ramsey’s “baby steps” provide a clear, structured path. While some find his approach rigid, millions have found success with his straightforward plan for getting out of debt and building a solid financial foundation. This is often cited as one of the best books on budget for beginners.

- Key Takeaways: The debt snowball method, the importance of an emergency fund, and a strong emphasis on behavior change.

- Best for: Individuals with significant debt, those who thrive on clear rules and a step-by-step process, and anyone needing a strong dose of motivation.

Must-Read for Young Adults Navigating Finances (Educational Guide)

- Title Suggestion: “Broke Millennial Takes On Investing” by Erin Lowry (or her original “Broke Millennial”)

- Why it’s a top pick: Erin Lowry speaks directly to the challenges and opportunities facing young adults today. Her writing is relatable, witty, and breaks down complex financial topics (like investing, in the follow-up book) into digestible pieces. This is excellent for building financial literacy early on.

- Key Takeaways: Practical advice on everything from managing student loans to understanding credit scores and starting to invest, all tailored to a younger audience.

- Best for: Millennials and Gen Z, recent graduates, and anyone who wants financial advice that feels current and unstuffy.

Comparing Budget Book Types: Choose What’s Right for You

| Type of Book | Core Description | Main Purpose | Example (from your article) | Best Suited For |

| Educational Budget Books (Guides & “Books on Budget”) | Books you read to build financial knowledge and understand money management principles. | Build financial literacy, understand the “why” and “how” of money, learn strategies. | “I Will Teach You To Be Rich” by Ramit Sethi, “The Total Money Makeover” by Dave Ramsey | Knowledge seekers, beginners, those wanting a deeper understanding of personal finance. |

| Practical Budget Planners | Tangible tools (usually notebooks) for tracking income, expenses, and setting goals. | Daily expense tracking, setting & monitoring financial goals, organizing bills. | Clever Fox Budget Planner PRO, The Budget Mom’s “Budget by Paycheck Workbook” | Action-takers, those who prefer manual tracking, seekers of a tangible system. |

Best All-in-One Budget Planner (Practical Tool)

- Product Suggestion: Clever Fox Budget Planner PRO

- Why it’s a top pick: This budget and finance planner is consistently praised for its comprehensive layout. It typically includes monthly calendars, expense tracking pages, dedicated sections for savings and debt repayment goals, and even mind maps or vision boards. It’s a robust budget book for those who like detail.

- Features We Love: Undated (start anytime), durable cover, multiple color options, sticker sets for customization, dedicated pockets for bills/receipts.

- Best for: Detail-oriented individuals, those who want a single planner for all their financial tracking and goal setting, and anyone who loves a structured, feature-rich system.

Top Budget Planner for Simplicity and Ease of Use (Practical Tool)

- Product Suggestion: The Budget Mom’s “Budget by Paycheck Workbook” (or similar simple ledger-style budget book)

- Why it’s a top pick: Sometimes, simpler is better, especially if you’re a budget book for beginner user when it comes to planners. Kumiko Love (The Budget Mom) offers workbooks and systems that are incredibly straightforward, often focusing on budgeting per paycheck, which many find more manageable.

- Features We Love: Clear, uncluttered layouts, focus on essential tracking, often paired with great online resources and community support.

- Best for: Those easily overwhelmed by too many bells and whistles, people who get paid bi-weekly or irregularly, and anyone who prefers a minimalist approach to their budget planner.

Best Value Budget Planner (Practical Tool)

- Product Suggestion: Mead Organizher Expense Tracker or a basic undated monthly/weekly planner with notes sections.

- Why it’s a top pick: You don’t always need to spend a lot to get an effective tool. Basic expense trackers or even a simple notebook, if used consistently, can be incredibly powerful. The key is functionality over fanciness if you’re on a tight budget yourself.

- Features We Love: Affordability, widely available, provides the core function of tracking income and outgo.

- Best for: Those on a very strict budget, students, or anyone who wants to test out a physical planning system before investing in a more expensive option.

Honorable Mentions & Free Budget Resources

- Other Notable Books: “Your Money or Your Life” by Vicki Robin and Joe Dominguez, “The Simple Path to Wealth” by JL Collins.

- Free budget book pdf Templates: A quick search online will reveal many free printable budget worksheets and templates. While they lack the structure of a bound planner, they’re a great way to start or for specific short-term tracking.

- Mint or Personal Capital: While not “books,” these free budgeting apps can complement your physical budget book by automatically tracking transactions and providing a digital overview.

Remember, the goal is to find tools that empower you. Whether it’s one of the best books on budgeting to shift your perspective or a practical budget planner to track your progress, the right resources are out there.

Checklist for Selecting Your Perfect Budget Book or Planner

| When Choosing an Educational Book, Look For: | When Choosing a Practical Planner, Consider: |

| • Author Credibility & Expertise | • Layout, Organization & Intuitive Use |

| • Clarity and Accessibility (plain English) | • Tracking Categories (flexibility or pre-set) |

| • Actionable Advice & Real-World Examples | • Dedicated Goal Setting Sections |

| • Relevance to Your Stage of Life | • Durability (if physical) |

| • Positive and Empowering Tone | • Expense Tracker / Bill Organizer Capabilities |

| • Extra Features (e.g., cash pouch, stickers, quotes) | |

| • Size and Portability |

Making Your Budget Book Work: Tips for Success and Sticking With It

Okay, so you’ve chosen your budget book or planner. Now what? Buying the tool is easy; using it consistently is where the real magic happens. Many people start with great intentions, only to have their new budget book gathering dust a few weeks later. Let’s make sure that doesn’t happen to you.

Setting Realistic Financial Goals: Your Roadmap to Motivation

Your “why” is your most powerful motivator. What do you want your money to do for you?

- Be Specific: Instead of “save more money,” aim for “save $500 for an emergency fund in the next 3 months” or “pay off $1,000 on my credit card in 6 months.”

- Write Them Down: Use the goal-setting pages in your budget planner. Seeing your financial goals regularly keeps them top-of-mind.

- Break It Down: Large goals can feel daunting. Break them into smaller, monthly or weekly targets. Saving $5,000 a year sounds big, but $417 a month (or about $96 a week) feels more achievable for many.

Imagine you’re saving for a down payment on a car. Your budget book isn’t just tracking expenses; it’s tracking progress towards driving off that lot. That’s a powerful motivator!

The Power of Tracking: Why Every Penny Counts (and How to Make it Easy)

“Beware of little expenses; a small leak can sink a great ship.”

– Benjamin Franklin

This is where the discipline of using your budget planner or the principles from your educational budget book comes in.

- Track Everything: Yes, even that $3 coffee. Small expenses add up. Use your expense tracker sections diligently.

- Be Honest: Don’t fudge the numbers to make yourself feel better. The goal is an accurate picture.

- Find a Rhythm: Will you update your budget book daily? Every few days? Weekly? Choose a frequency that works for you and stick to it. Many find 10-15 minutes each evening or a dedicated hour on Sunday works well.

- Use Categories: Categorizing your spending (groceries, transport, entertainment) helps you see where your money is really going. Most budget planners have pre-set or customizable categories.

Review, Reflect, and Adjust: Your Budget Isn’t Set in Stone

Life happens. Your income might change, unexpected expenses pop up (hello, car repair!), or your priorities might shift. That’s okay! Your budget is a living document, not a rigid prison.

- Monthly Review: At the end of each month, compare your actual spending (from your budget book) against your planned budget. Where did you overspend? Where did you save?

- Learn and Adjust: Don’t beat yourself up over deviations. Use them as learning opportunities. If you consistently overspend on groceries, maybe your grocery budget was unrealistic, or perhaps you need to find new ways for how to budget and save money in that area.

- Plan for the Next Month: Based on your review, adjust your budget for the upcoming month.

Think of it like navigating. You set a course, but you might need to make small adjustments along the way to stay on track to your destination.

Staying Motivated: Celebrating Milestones and Overcoming Setbacks

Budgeting is a marathon, not a sprint.

- Celebrate Small Wins: Did you stick to your budget for a whole month? Did you hit a savings mini-goal? Acknowledge it! Treat yourself (within reason and within your new budget, of course!).

- Find an Accountability Partner: Sharing your goals with a trusted friend or family member can help you stay on track.

- Remember Your “Why”: When motivation wanes, revisit those financial goals you wrote down in your budget planner. Visualize achieving them.

- Don’t Let Setbacks Derail You: Everyone has an off month. The key is to get back on track with the next paycheck, not to give up entirely.

Beyond the Books: Complementary Tools and Habits for Budgeting Mastery

While budget books and planners are fantastic, they often work best as part of a broader financial toolkit and mindset.

Leveraging Budgeting Apps Alongside Your Planner/Book

Many people find a hybrid approach works wonders. You might use a physical budget planner for its tactile nature and detailed planning, but also use a free app like Mint or Personal Capital.

These apps can often link to your bank accounts and credit cards to automatically categorize transactions, giving you a quick digital overview and helping you catch anything you might have missed in your manual tracking. They can be a great cross-reference.

The Importance of a Regular Financial “Check-up”

Just like you go for an annual physical, your finances need regular check-ups. This could be a quarterly deep dive (beyond your monthly review) where you assess your overall financial health, review your investment performance (if applicable), and ensure your long-term financial goals are still on track and relevant. This is where the knowledge from your educational books on budget truly comes into play.

Building an Emergency Fund: Your Financial Safety Net

No budget book can fully protect you from life’s unexpected curveballs – a job loss, a medical emergency, an urgent home repair. That’s where an emergency fund comes in. Most financial experts recommend saving 3-6 months’ worth of essential living expenses in an easily accessible savings account.

Prioritizing this in your budget planning is one of the smartest financial moves you can make. It prevents you from derailing your entire financial plan or going into debt when surprises hit.

Take Control of Your Financial Future with the Right Budget Book

“You must gain control over your money or the lack of it will forever control you.” – Dave Ramsey

Navigating the world of personal finance can feel overwhelming, but it doesn’t have to be. Whether you’re just starting to learn about how to budget and save money or you’re looking for a better system to manage your cash flow, budget books – in both their educational and practical forms – offer powerful pathways to clarity and control.

From understanding foundational concepts like the 50/30/20 rule to meticulously tracking your spending in a dedicated budget planner, the journey to financial wellness is built on knowledge and consistent action. The best books on budgeting can provide the wisdom, while the best budget book for beginners (in planner form) can provide the structure.

Remember Sarah, our graphic designer? Or think of Mark, a recent U.S. college grad drowning in student loan statements and takeout receipts. He felt like he was working hard at his first job but had nothing to show for it.

After reading one of the budgeting books for young adults we mentioned and committing to a simple budget planner, he identified where his money was vanishing. Within a year, he had a clear plan, was making extra payments on his loans, and even started a small “travel” savings pot. It wasn’t magic; it was intentionality, guided by the right tools.

Your financial future isn’t something that just happens to you; it’s something you build, one smart decision at a time. Choosing to use budget books is one of those foundational smart decisions. So, pick a guide that resonates, select a planner that fits your style, and commit to the process.

The peace of mind and the progress towards your financial goals will be well worth the effort. Unlock your financial freedom – your journey starts now.

More from our Finance Blog:

- Land Payment Calculator: Master Your Land Costs

- Share Certificates: How They Work & Why They Matter

- Money Mindset: Shift Your Thinking for Financial Freedom

- Top Salary-Saving Schemes to Grow Your Wealth

- Stock split calculator: The Best Tool for Savvy Investors

- 5 Easy Best Banks that Work with Bankruptcies for Auto Loans